SFDR Statement

Evenpar General Partner B.V. makes the following disclosures in accordance with articles 3(1), 4 (1) (b) and 5(1) of the SFDR.

Sustainability Risk Policy (Article 3 SFDR)

According to article 3 of the SFDR, financial advisors shall publish on their websites information about their policies on the integration of sustainability risks in their investment decision process.

“Sustainability risk” is defined in the SFDR as an environmental, social or governance event or condition which, if it occurs, could cause an actual or potential material negative impact on the value of an investment.

Responsible investment and environment, social, and governance (ESG) integration are at the heart of Evenpar’s investment strategy. Evenpar aims to take sustainability risks into account before any investment decision is made. Evenpar also performs due diligence covering qualitative sustainability risks, ensuring that they are incorporated into the assessment and recommendation provided to the investment committee. The investment committee then advises on the feasibility of the investment based on the relevant investment policy and objectives. Our commitment to addressing these risks is expressed in our ESG Policy, which includes environmental impact, Engineering, Construction and Operations principals in its ESG policy, as well as Health and Safety, Supply Chain responsibility, Sexual exploitation, Abuse and Harassment.

Evenpar investments are made with the intention to generate financial returns as well as create social and environmental impact – by utilizing effective technology to efficiently process low value available feedstock input to high value needed water or energy output.

Whilst simultaneously creating: Access to Energy, Access to Water, Poverty Reduction, Decentralized power production, Waste utilization (prevent contamination), Water sanitation, Reduction of CO2, Knowledge transfer, capacity building and productivity growth.

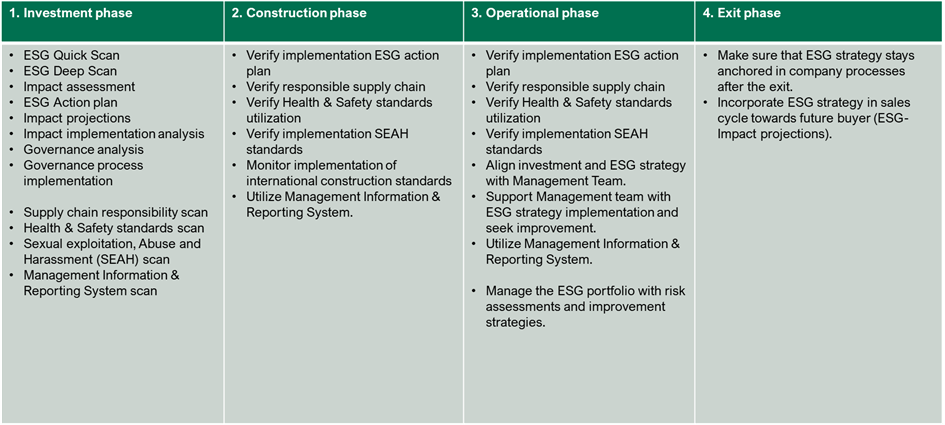

The Evenpar ESG process is executed as follows:

Principle Adverse Impacts (Article 4 SFDR)

Financial market participants are required under article 4 of the SFDR to disclose whether they consider principal adverse impacts of their investment decisions on sustainability factors and if this is the case, to disclose a statement on their due diligence policies regarding those impacts.

Evenpar does not assess the principal adverse impacts of its investment decisions on sustainability factors at the entity level, as defined by the SFDR. This decision stems from our status as a small enterprise with limited resources and personnel. Consequently, we lack the capability to precisely quantify the adverse impacts of our investment decisions based on the diverse criteria outlined in the SFDR and its guidelines. The unavailability of relevant data further contributes to this decision, given our focus on investing in small and medium-sized entities with limited resources. Given these circumstances, Evenpar cannot assure the current requisite completeness and quality necessary for public disclosure. Evenpar, in a manner proportionate to its size, the nature and scale of its activities and the nature of its investment strategy, considers the principal adverse sustainability impacts of investment decisions on sustainability factors as defined under and in accordance with the SFDR.

This position will undergo periodic reassessment in alignment with market practices, data availability, and regulatory changes. Evenpar is committed to advancing the quality and comprehensiveness of this information on an annual basis.

Remuneration Policy (Article 5 SFDR)

According to article 5 of the SFDR, financial market participants shall include in their remuneration policies information on how those policies are consistent with the integration of sustainability risks and shall publish that information on their websites.

Evenpar is registered as a ‘light’ manager in terms of the Alternative Investment Fund Managers Directive (‘AIFMD’) and is as a consequence not required to prepare a remuneration policy as described in the AIFMD. Evenpar pays staff a combination of fixed remuneration (salary and benefits) and variable remuneration (including bonus and/or carry). Variable remuneration for qualifying staff considers, among other factors, compliance with internal policies and procedures, including those relating to the impact of sustainability risks on the investment decision making process and does not contain any incentives that could lead to sustainability risks being disregarded when making investment decisions and monitoring such investments made.